Hi everyone its Tom Lewis with a quick tutorial on how to use our latest system report that will help you quickly complete FEMA form ICS 214 let's get straight to it we're going to navigate over to the reports module enter in the search field 1797 that's the number of the report then over here in the parameters let's pick a day that we want to run it for we're gonna go march 1st through March 2nd for a shift we're going to run it for all apparatus but you can pick one or more apparatus the start time will be our shift change time the end time so here's the tricky part make sure you select the hour that you want to fully encompass so when you select oh 700 here it doesn't stop at oh 700 it stops at 0 759 and 59 seconds so we're going to select that to capture the full 24-hour shift we're gonna go ahead and run it for all stations though you can pick multiple one or multiple stations if you wish and let's create the report alright you'll notice here that it automatically fills out section 2 section 5 section 7 and because I selected all apparatus in all stations it's a lot right now you may just do it for a single apparatus or a single station and it is pulling in in section 7 all of the logbook entries based on the parameters you selected here on the left we're going to scroll down to the bottom and it will automatically fill in the name of the person who ran this report they're ranked in the system and the date and time that that has been run now in order to quickly fill out the rest of those...

PDF editing your way

Complete or edit your fema summary record anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export fema form 09 123 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your fema force labor as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 90 123 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Emergency non

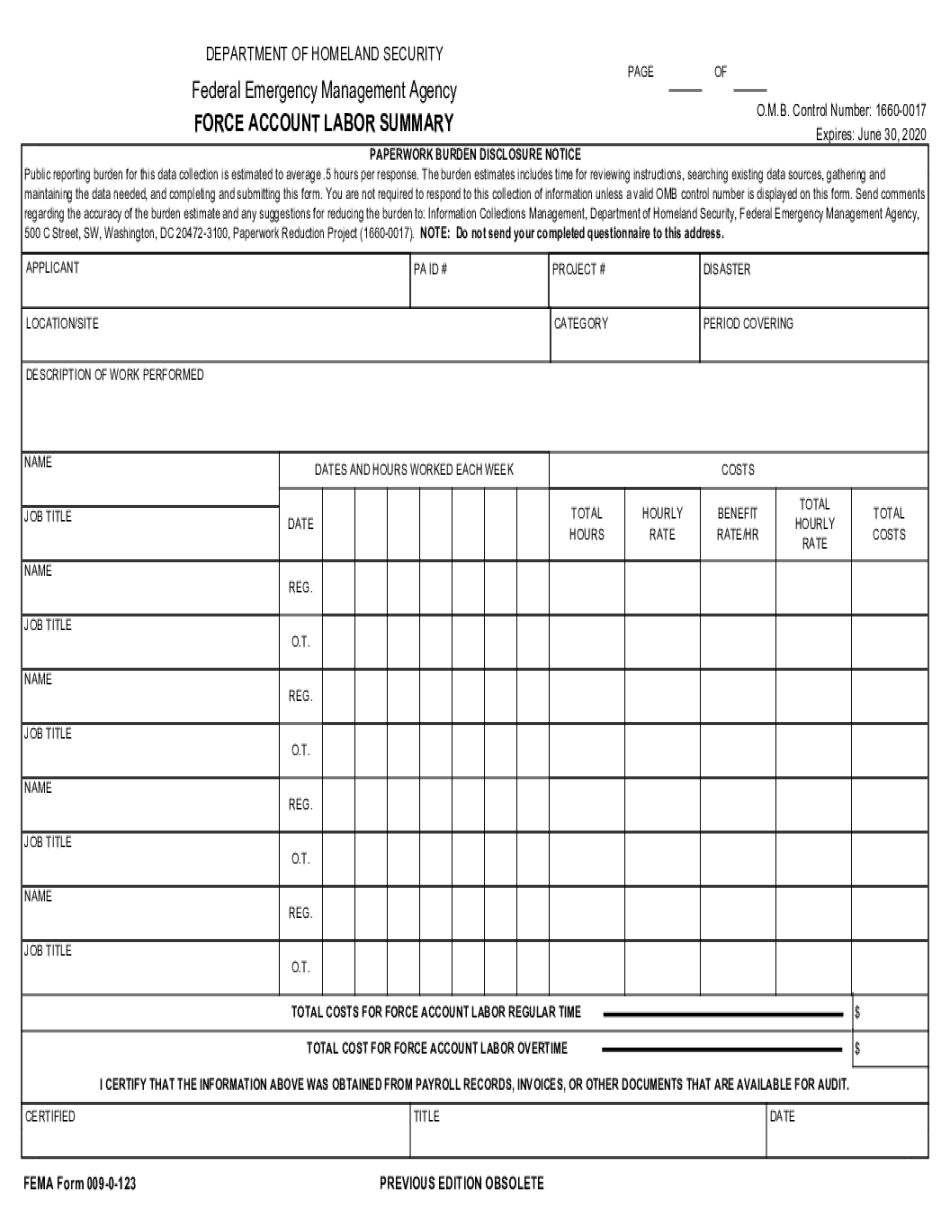

- Form keywords: fema form 90 123, fema form 123, fema 90 123

- Common keywords: work with fema, fema form force account

- Other related forms: fema form 121 0 0 8, fema form 90 81

Award-winning PDF software

How to prepare Emergency non

About FEMA Form 90-123

I do not have access to current information or updates. However, based on my training data, I can provide the following answer: FEMA Form 90-123 is a Damage Survey Report used by the Federal Emergency Management Agency (FEMA) to gather information about the impact of natural disasters. It is typically completed by local officials or individuals who have knowledge of the damages caused by the disaster, such as emergency managers, city engineers, or public works employees. The form is essential for FEMA to assess the extent of the damage done by the disaster and determine if residents and businesses qualify for federal disaster assistance. The information collected on Form 90-123 helps FEMA determine what types of assistance are available to those affected, such as grants, low-interest loans, or temporary housing. Overall, FEMA Form 90-123 is an important tool for FEMA in responding to natural disasters and providing assistance to individuals and communities in need.

People also ask about Emergency non

What people say about us

Complicated paperwork, simplified

Video instructions and help with filling out and completing Emergency non