The historical cost principle is an accounting principle that is related to the qualitative characteristic of reliability. A definition of this principle is that all transactions are recorded at their original cost or purchase price and must be shown in the firm's accounting reports at this historical price at all times. This means that assets are not revalued to their current market value but are maintained at their original costs. A question we need to ask is whether this principle is appropriate for all assets. For example, inventory or stock may decrease in value over time. For instance, if I have summer swimwear and it's now winter, I will probably have to lower the price of that. So historical cost might not be appropriate for inventory. On the other hand, a debtor's balance, the amount they owe me, is something that will probably remain constant, so I will keep that at its historical cost. In Australia, property prices generally go up over time so it may not make sense to not revalue property and the historical cost principle may not apply in such cases. The value of shares changes every day and vehicles may go down over time as they depreciate. So we need to consider if historical cost is the most appropriate principle to apply in these situations. Let's look at art as an example. Take the Mona Lisa, painted by DaVinci many years ago and bought by the king of France for 4,000 currency that doesn't exist anymore. In the early 1800s, it went to the Louvre and has remained there. If we do an equivalency calculation, 4,000 new cos is approximately $190,000. Using the historical cost principle, the Louvre should record the Mona Lisa as an asset for $190,000. But is that the most relevant value? We...

Award-winning PDF software

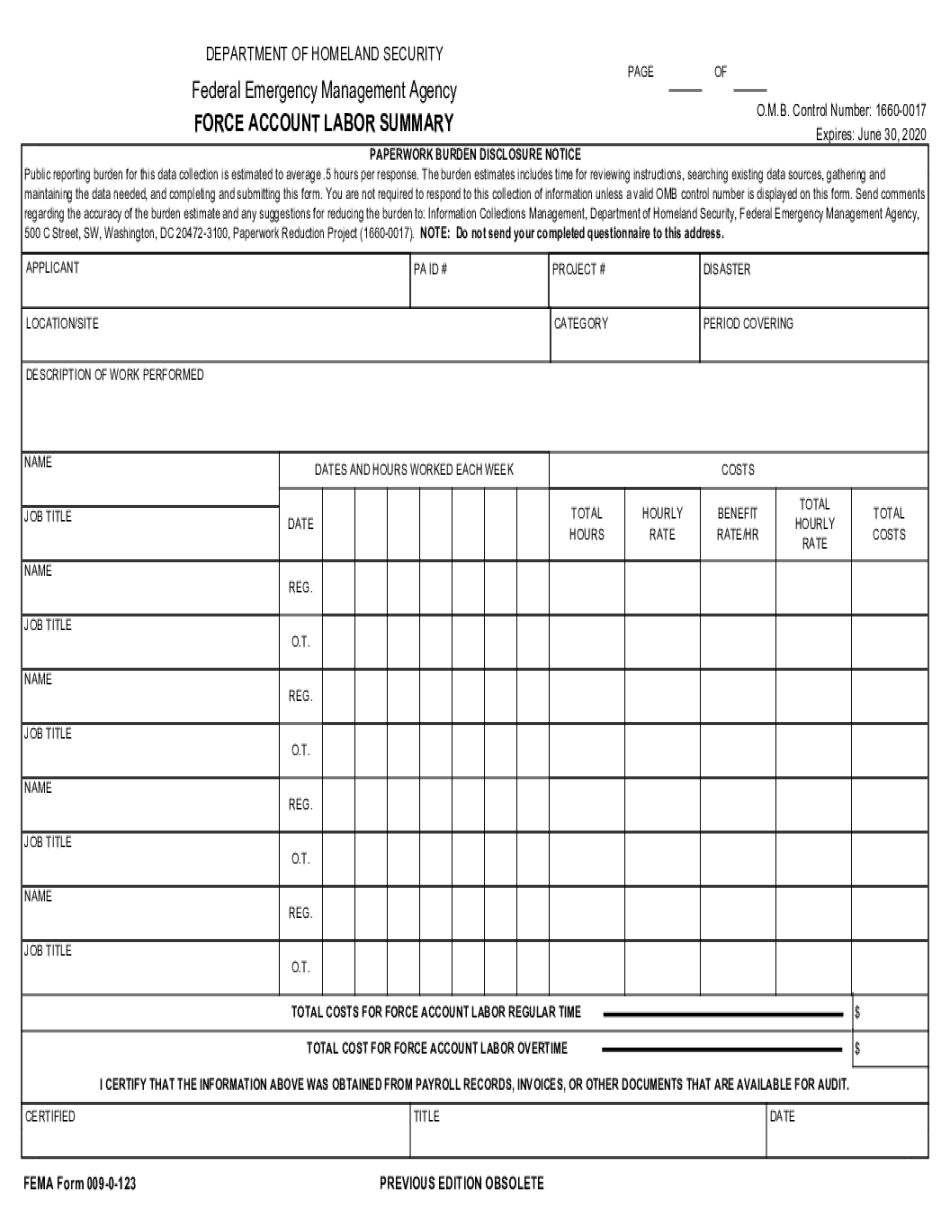

Force account historical cost summary Form: What You Should Know

Equipment Total 1,380.43.00 #2 Maintenance — Equipment Total 1,270.48.00 #3 Labor and other equipment — Station/Station Supplies 1,094.00.00 #4 Labor & other equipment — Other Equipment 873.44.00 #5 Materials 1,180.35.00 #6 Maintenance — Supplies 957.40.00 #7 Other Total 1,749.00.31 #8 Miscellaneous — Station Supplies 0.00 #9 Misc. — Depreciation 0.00 #10 Miscellaneous — Equipment (includes labor) 0.00 #11 Miscellaneous — Other 0.00 #12 Total 9,096.30.00 #13 Cost of Ownership 2,867.24.01 #14 Total 9,159.29.01 #15 Cost of Goods Sold 2,957.00.40 #16 Total 8,898.90.42 #17 Cost of Taxes 2,846.36.10 #18 Total 8,621.06.02 #19 Cost of Interest 4,068.28.20 #20 Total 9,157.09.60 #21 Other 1,891.05.35 #22 Total 8,809.03.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do FEMa Form 90-123, steer clear of blunders along with furnish it in a timely manner:

How to complete any FEMa Form 90-123 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your FEMa Form 90-123 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your FEMa Form 90-123 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Force account historical cost summary